EIC Fund - Overview & Investment Strategy

The European Innovation Council (EIC) Fund is the investment vehicle of the EIC Accelerator programme - the EC's flagship innovation funding programme. With a budget of €3 billion from 2021-2027, the EIC Fund is positioned to be one of Europe's largest deep-tech venture capitalists (VCs) during this period. Through the structure of the fund, a minimum of €3 billion of private funds will be invested alongside the EIC Fund during this period. The EIC aspires to crowd in a further €30bn-€50bn as one of its six strategic goals.

The EIC Accelerator supports individual Small and Medium Enterprises (SMEs), in particular Startups and spinout companies to develop and scaleup game-changing innovations. The EIC Accelerator provides substantial financial support with:

- Grant funding (non-dilutive) of up to €2.5 million for innovation development costs,

- Investments (direct equity investments) of up to €15 million managed by the EIC Fund for scale up and other relevant costs.

The EIC Fund provides the investment components of the EIC blended finance awarded by the EC.

The EIC Fund is a venture capital fund owned by the European Commission established to make direct equity investments in companies with breakthrough technologies. The Fund usually targets minority ownership stakes (10 to 20%). Furthermore, it participates in direct equity investment ranging between €0.5 million to €15 million in innovative companies that pass the rigorous EIC Accelerator selection process. The Fund invests on a matching (1:1) basis alongside a syndicate of lead investors from the private market. More information on the EIC fund can be found on the EIC's webpage.

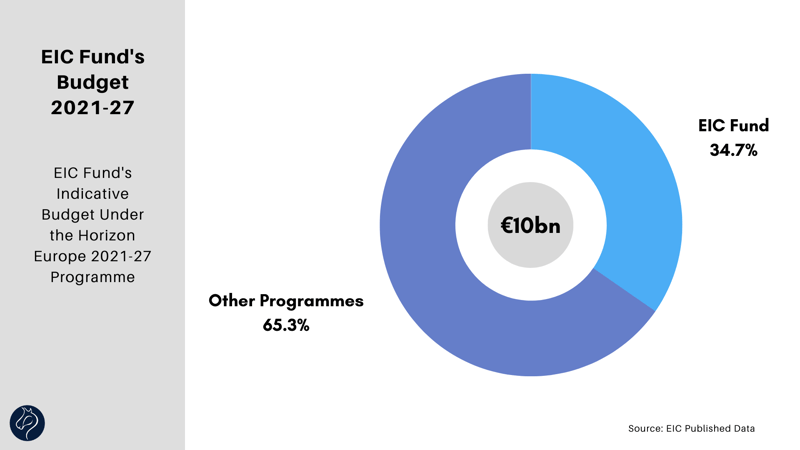

The EIC has a budget of €10 billion for the period 2021-2027, and the EIC Accelerator is expected to receive the largest share of this budget. Furthermore, around €3 billion of the EIC's budget will go towards the EIC Fund, with an expected yearly allocation of approximately €300 million.

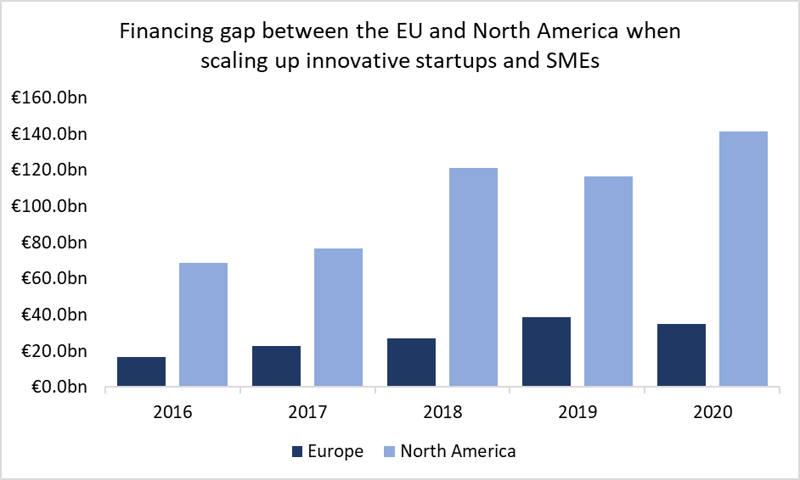

Ultimately, the EIC Fund’s goal is to enable innovative companies to scale up and commercialise their technologies by bridging the financing gap. Since 2016, EU venture capital investment has severely lagged behind U.S. venture capital investment. Research by the EIC shows that U.S. venture capital investment has been 4-5 times higher than EU investment during the period 2016-2020.

Source: Introduction to the EIC Fund, p.4. Conversion rate: 1 EUR:1.0007 USD, 14/09/2022.

Source: Introduction to the EIC Fund, p.4. Conversion rate: 1 EUR:1.0007 USD, 14/09/2022.

The EIC plans to tackle the EU-North America funding disparity by crowding between €30bn-€50bn in impact investments. Each € of EIC financial support has triggered follow-on investments of €2.4 thus far. One of the EIC's short-term goals includes multiplying the value of taxpayers' money by 3-5x via co-investments and follow-on investments. Plenty of evidence supports the "crowd-in" principle - the idea that government-sponsored VCs stimulate private investment rather than replace it. Click here for more information on this topic.

The EIC Fund's investment strategy:

- Early-stage equity investments (seed, start-up, scale-up).

- Possible follow-on investment.

- EU-wide investments across all types of technologies and verticals.

- Long time horizon (7-15 years).

- Minority ownership stakes between 10-20%.

Read more: https://landing.winnovart.com/eic-fund-overview

For ongoing updates about the EIC Fund you can subscribe to our regular updates, please get in touch with us, or follow us on Facebook, LinkedIn, Twitter.