EIC Fund - Explainer Series 1 (EIC Fund)

The EIC Fund is Europe's flagship blended funding programme, combining EC innovation grants with equity investments from private investors (typically VCs). The biggest programme of this kind in Europe with a substantial multi-annual investment budget. There is, however, a significant gap between its promise and current delivery.

This is our series of Explainers, aiming to clarify key aspects of this programme: The EIC Fund's mission and HOW it works.

What is the EIC Fund and How does it Work?

What is the EIC Fund?

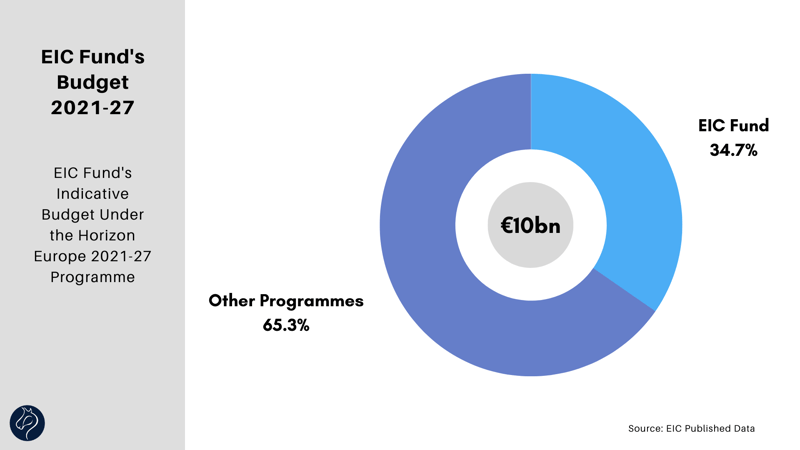

The European Innovation Council (EIC) Fund is the investment vehicle of the EIC Accelerator programme - the EC's flagship innovation funding programme. With a budget of €3 billion from 2021-2027, the EIC Fund is positioned to be one of Europe's largest deep-tech venture capitalists (VCs) during this period. Through the structure of the fund, a minimum of €3 billion of private funds will be invested alongside the EIC Fund during this period. The EIC aspires to crowd in a further €30bn-€50bn as one of its six strategic goals.

The EIC Accelerator supports individual Small and Medium Enterprises (SMEs), in particular Startups and spinout companies to develop and scaleup game-changing innovations. The EIC Accelerator provides substantial financial support with:

-

grant funding (non-dilutive) of up to €2.5 million for innovation development costs,

-

investments (direct equity investments) of up to €15 million managed by the EIC Fund for scale up and other relevant costs.

The EIC Fund is a venture capital fund owned by the European Commission established to make direct equity investments in companies with breakthrough technologies. The Fund usually targets minority ownership stakes (10 to 20%). Furthermore, it participates in direct equity investment ranging between €0.5 million to €15 million in innovative companies that pass the rigorous EIC Accelerator selection process. The Fund invests on a matching (1:1) basis alongside a syndicate of lead investors from the private market.

The EIC has a budget of €10 billion for the period 2021-2027, and the EIC Accelerator is expected to receive the largest share of this budget. Furthermore, around €3 billion of the EIC's budget will go towards the EIC Fund, with an expected yearly allocation of approximately €300 million. In 2022, the EIC Accelerator accounted for €1.16 billion of the EIC’s €1.7 billion annual budget.

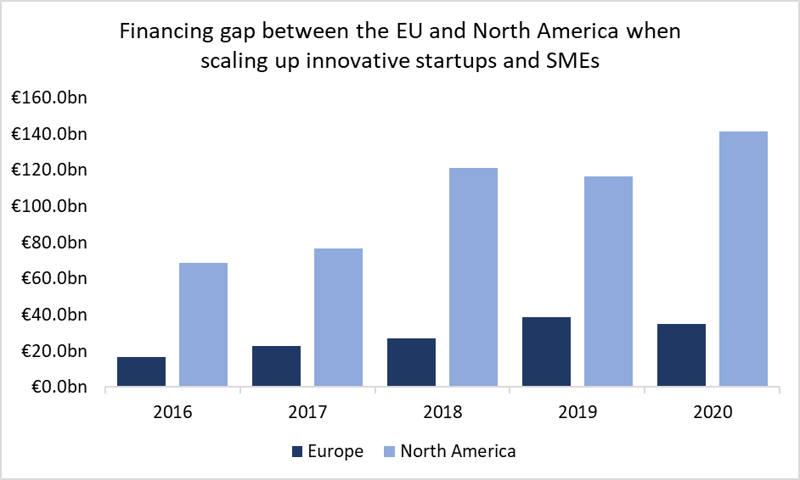

Ultimately, the EIC Fund’s goal is to enable innovative companies to scale up and commercialise their technologies by bridging the financing gap. Since 2016, EU venture capital investment has severely lagged behind U.S. venture capital investment. Research by the EIC shows that U.S. venture capital investment has been 4-5 times higher than EU investment during the period 2016-2020.

Source: EIC Published Data. Conversion rate: 1 EUR:1.0007 USD, 14/09/2022.

Source: EIC Published Data. Conversion rate: 1 EUR:1.0007 USD, 14/09/2022.

How does the EIC Fund work?

The EIC Fund has three specific tasks. First, the fund deals with "the overall due diligence of the proposed transactions for the potential investment component and the subsequent implementation of the investment component of the EIC blended finance awarded by the EC." Second, the Fund is tasked with "raising awareness and interests among investors to leverage and crowd-in co- and alternate investments over the lifetime of the EIC Fund investment." Third, the Fund is responsible for "the management and exit from the investment to the combined benefit of the beneficiary and of the EU interests."

The EIC works with EIC Investment Partners to implement and manage the investment component of EIC Accelerator blended finance. Until September 2022, the EIC Fund was the EIC's only Investment Partner (transition phase). Recently, the EC appointed Luxembourg-based AlterDomus as the new external fund manager of the EIC Fund.

Currently, the European Investment Bank (EIB) is an investment adviser to AlterDomus. The EIB and the EIC Fund manager (AlterDomus) are completely different and separate legal entities. The EIB provides advice and support to AlterDomus but does not make any investment decisions. Within the mandate given by the Commission, the EIC Fund manager makes decisions on investments, their structure and terms, follow-on investments and divestments in accordance with the EIC investment guidelines and having regard to the recommendations of the EIB as an investment adviser.

Read more: https://landing.winnovart.com/eic-fund-overview-of-explainer-series

For ongoing updates about the EIC Fund, you can subscribe to our regular updates, please get in touch with us, or follow us on Facebook, LinkedIn, Twitter.