Winnovart Survey – Do you still need consultants for funding applications?

At Winnovart, during the past 10 years, we have helped companies raise over €75 million in grants-based funding. Do YOU still NEED us?

Read More

At Winnovart, during the past 10 years, we have helped companies raise over €75 million in grants-based funding. Do YOU still NEED us?

Read More

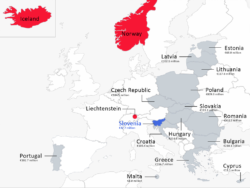

Slovenia will get EUR 40 million under the EEA & Norway Grants 2014 – 2021, being one of the 15 Beneficiary States across the EU in this new funding cycle, to have signed the Memorandum of Understanding with the Donor States (Norway, Iceland and Liechtenstein).

Read More

Lithuania will get EUR 122 million under the EEA & Norway Grants 2014 – 2021, being one of the 15 Beneficiary States across the EU in this new funding cycle, to have signed the Memorandum of Understanding with the Donor States (Norway, Iceland and Liechtenstein).

Read More

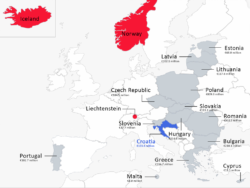

Croatia will get EUR 104.5 million under the EEA & Norway Grants 2014 – 2021, being one of the 15 Beneficiary States across the EU in this new funding cycle, to have signed the Memorandum of Understanding with the Donor States (Norway, Iceland and Liechtenstein).

Read More

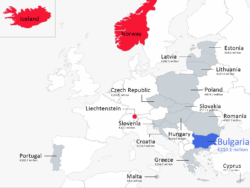

EUR 18 million for implementing green innovation projects on the Bulgarian market under the ‘Business Development, Innovations and SMEs’ Programme, operated by Innovation Norway. The Programme is divided into 2 funding streams:

Read More

EUR 21 million will be available to SMEs, Large enterprises via the SME Growth Programme in Romania, to be operated by Innovation Norway. 3 focus areas: Green Industry Innovation (EUR 9.7 million), Blue Growth (EUR 6.5 million), ICT (EUR 4.8 million).

Read More

At Winnovart we care about GDPR.

Read More

Only 20% of UK small and medium enterprises eligible to receive tax refunds for innovation apply. These 20% received £1.3 billion in the 2015-2016 tax year alone. Altogether, SMEs and large enterprises have received nearly £3 billion in this period. For more information on the R&D Tax Credits you could also read our summary of the statistics on the R&D Tax Credits in the UK pulished by HMRC,...

Read More

At Winnovart, our focus has always been grants-based funding programmes, such as the ones from Innovate UK, EC/ Horizon 2020 or similar. Although under different terms, the Reaserch & Develpment (R&D) Tax Credit scheme offered by HMRC represents a way faster and less competitive alternative for R&D performing / innovative companies in the UK to receive a “funding-type” support. Or, for those...

Read More

Bulgaria will get approximately EUR 210 million under the EEA & Norway grants 2014-2021 out of which EUR 56.5 million will bededicated to the business sector via 2 programme areas and first calls expected to open during 2018:

Read More